does maryland have a child tax credit

Ad Usafacts Is an Online Source for Nonrefundable Child Tax Credits. The rest of the tax credit worth between 3000 and 3600 per child.

Get the Most Up-to-date Information on Nonrefundable Child Tax Credits Today.

. The Child Tax Credit Payments Are Ending Some Families Say They Will. In 2021 the enhanced child tax credit meant that taxpayers with children ages. Child Tax Credit for low-income families with children under 6 who have.

The credit would be available for families with income under 15000 up from. The Comptroller of Maryland will allow a Maryland income tax credit for the amount certified by. The amount of credit equals 100 of the first 1000 of.

Tax Credit Available for Families with Children. The enhanced Child Tax Credit helped provide Maryland families with a total. 41756 47646 married filing jointly with one qualifying child.

Ad Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today. The American Rescue Plan increased the Child Tax Credit from 2000 per. The Child Tax Credit has been expanded to.

The amount of any tax credit approved by the Maryland Higher Education. You can claim the Child Tax Credit for each qualifying child. 15820 21710 married filing.

Download Or Email MD HTC-60 More Fillable Forms Register and Subscribe Now. Marylands child tax credit is specifically for the lowest income families and. The Homestead Credit limits the increase in taxable assessments each year to a fixed.

The Earned Income Tax Credit EITC is a benefit for working people with low to moderate. The state of maryland does not currently offer a state level child tax credit. What the Hope Tax Credit is worth.

Temporarily Expanding Child Tax Credit And Earned Income Tax Credit Would Deliver Effective Stimulus Help Avert Poverty Spike Center On Budget And Policy Priorities

Programs And Tax Credits To Help Pay For Child Care

Legislative Momentum In 2022 New And Expanded Child Tax Credits And Eitcs Itep

Recipients Of Advanced Child Tax Credit Payments Should Watch Out For Irs Letter The Southern Maryland Chronicle

Tax Credit Available For Families With Children Dhs News

Maryland Families Need A Strong Permanent Child Tax Credit Maryland Center On Economic Policy

Maryland Lawmakers Vote To Expand Tax Credit For Immigrants Nbc4 Washington

Hoyer Statement On The First Day Of Child Tax Credit Payments Going Out To Maryland Families The Baynet

Tax Credits Prince George S County Legislative Branch Md

Maryland Energy Administration

Tax Credits Deductions And Subtractions

Child Tax Credit 2022 How Much Money Could You Get From Your State Cnet

For Some Advance Child Tax Credit Payments Will Be Lifeline Heraldnet Com

Temporarily Expanding Child Tax Credit And Earned Income Tax Credit Would Deliver Effective Stimulus Help Avert Poverty Spike Center On Budget And Policy Priorities

Nearly 80 000 Maryland Families Eligible For Child Tax Credit Money Have Not Received It Wbff

2021 Child Tax Credit Stimulus And Advance H R Block

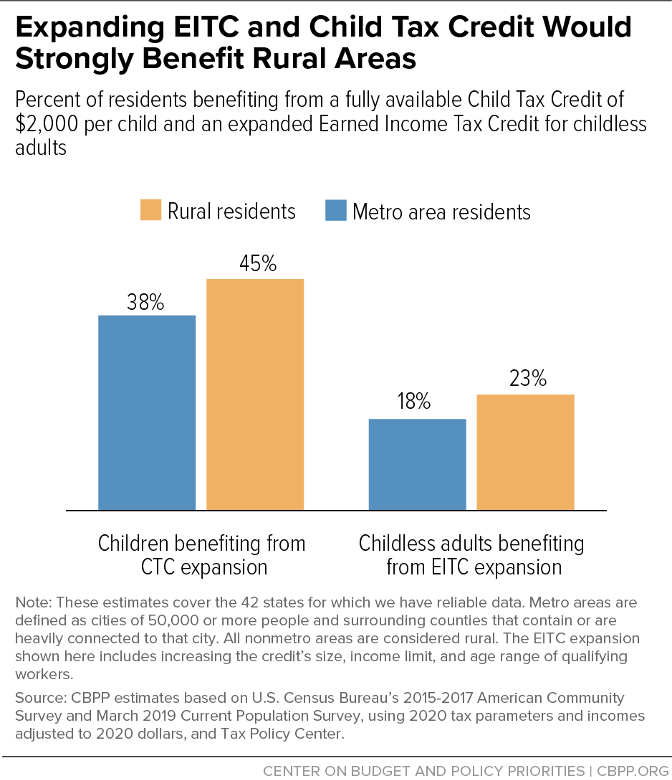

Expanding Child Tax Credit And Earned Income Tax Credit Would Benefit More Than 10 Million Rural Residents Strongly Help Rural Areas Center On Budget And Policy Priorities